Taxation: Abuja Chamber calls for reforms to save SMEs in Nigeria

Share

The Abuja Chamber of Commerce and Industry (ACCI), has called for urgent tax reforms to safe Small and Medium Enterprises (SMEs) from demands for tax even before they begin to make profit.

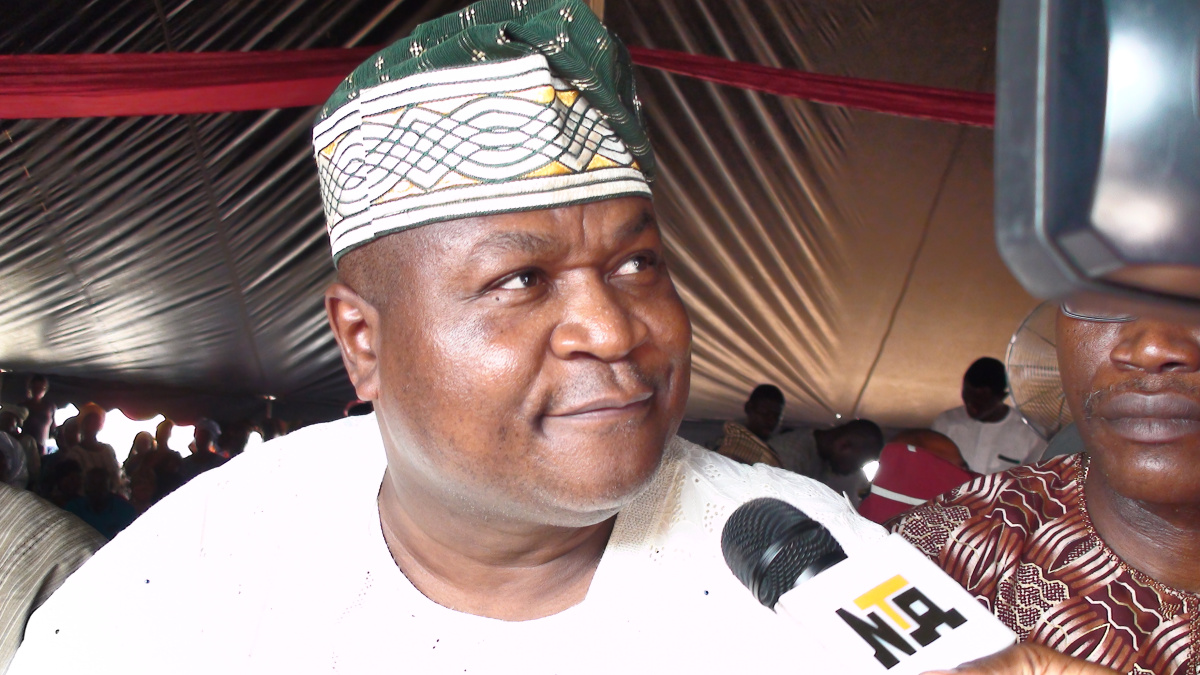

Mr Adetokunbo Kayode, President of the chambers made the call in a statement signed by Mr Gena Lubem, the Media and Strategy Officer of ACCI in Abuja on Monday.

Kayode said that the practice of mandatory requirement for tax clearance from companies newly registered was a disincentive for the growth and thriving of SMEs in the country.

According to him, it is also one of the stumbling blocks in the Ease of Doing Business.

While noting the ongoing progress in national tax reforms, he advised tax authorities to immediately review the tax clearance system to reduce the burden placed on new companies sprouting up across the country.

“The growth of Small, and Medium Enterprises depends very much on the enabling environment the government is able to create for them to grow.

“Their growth will in turn create jobs and collective wealth for the nation. All that is necessary must be done to nurture such new businesses.

“New companies should not be mandated to produce tax clearance until after a year or so of operations,’’ he said.

Kayode said that members of the chambers had also lamented the negative effect of that policy in their efforts to run their legitimate businesses.

“SMEs must not be taxed on operations but on profit. Company’s duty is to pay tax on profit only if there is a profit. You are not to pay tax if you have not made profit or if you made a loss.

“We want to see a situation where companies will be taxed on profit not on any other affiliation.

“This means that a business must pay tax on the profit it has made over a period of time as stipulated by the appropriate law,’’ he said.

According to him, the situation on ground is where companies are whipped into paying all manner of taxes, levies and other forms of payments to the three tiers of government.

“If this country must grow and have a vibrant economy, the plight of the SMEs must be adequately taken into account.

“SMEs are of fundamental importance to us due to the meaningful contribution they add to economic development.

“They are constantly expanding output, generating employment, and redistributing income, promoting indigenous entrepreneurship and greatly producing primary goods that strengthen industrial linkages.

“The sector is accountable for about 85 per cent of the total industrial employment in the country and between 10 to15 per cent of the total manufacturing output,’’ he said. (NAN)