Islamic Development Bank starts marketing 5-year-dollar sukuk

Share

Islamic Development Bank (IsDB) has started marketing a five-year dollar sukuk, or Islamic bond, a document issued by one of the banks showed.

The Jeddah-based triple A-rated institution gave initial price guidance in the high 40 basis points over mid swaps area, the document showed.

IsDB has appointed Credit Agricole CIB, Emirates NBD Capital, Gulf International Bank, HSBC, JPMorgan, Natixis

and Standard Chartered as joint lead managers and book runners.

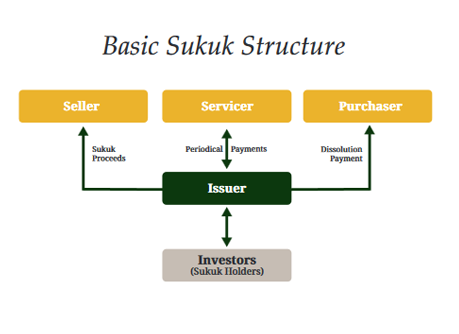

Sukuk is the Arabic name for financial certificates, also commonly referred to as “sharia compliant’’ bonds.

Sukuk is defined by Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI)

as “securities of equal denomination representing individual ownership interests in a portfolio of eligible existing or future assets.

Islamic bonds, structured in such a way as to generate returns to investors without infringing Islamic law (that prohibits riba or interest).

Sukuk represents undivided shares in the ownership of tangible assets relating to particular projects or special investment activity.

(Reuters/NAN)