European Stocks close 3.6% lower and enter correction territory amid Coronavirus Fears

Share

European stocks closed sharply lower Thursday as the rapid spread of the coronavirus weighed heavily on market sentiment.

SEE ALSO: PIN Code Verification Feature Now Available For All Uber Riders In Nigeria

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE | VOLUME |

|---|---|---|---|---|---|---|

| FTSE | FTSE 100 | FTSE | 6796.40 | -246.07 | -3.49 | 1224826952 |

| DAX | DAX | DAX | 12367.46 | -407.42 | -3.19 | 191240879 |

| CAC | CAC | CAC | 5495.60 | -188.95 | -3.32 | 216328055 |

The pan-European Stoxx 600 closed 3.6% lower provisionally, officially entering correction territory as it was off more than 10% from its record high notched on Feb. 19 last year. The index also hit a 4-month low, while all the major indexes were firmly in the red. Germany’s DAX finished lower by 3.1%, Britain’s FTSE was down 3.5%, while France’s CAC 40 fell 3.2%.

The spread of the coronavirus which has now infected more than 81,000 people and killed over 2,700 — continues to rattle markets and policy makers around the world.

The European countries of Estonia and Denmark both reported their first confirmed cases of coronavirus Thursday morning, while the U.K. also reported two more cases. It comes as China’s National Health Commission said there were 433 new confirmed cases in the country and 29 additional deaths as of Feb. 26.

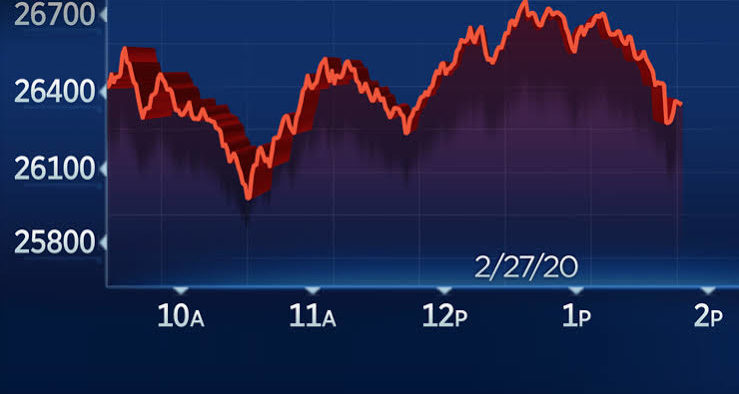

On Wall Street, equities dived with the Dow Jones industrial average falling about 580 points as traders digested the latest news around the coronavirus. The S&P 500 and Nasdaq indexes were also firmly in the red.

On the data front, euro zone economic sentiment in February came in at 103.5, up from 102.6 in January and beating consensus expectations for a reading of 102.2, while consumer confidence came in at -6.6, up from -8.1 in January. Bank lending to euro zone businesses remained unchanged in January, according to the European Central Bank (ECB).

Earnings in focus

Standard Chartered posted a 46% rise in annual profit on Thursday but warned that the coronavirus will slow progress towards its 10% ROTE (return on tangible equity) target. The British lender’s shares fell nearly 4%.

WPP shares plunged 16% to the bottom of the Stoxx 600 after the world’s largest advertising firm saw a slowdown in fourth-quarter sales and projected a flat 2020.

Bucking the trend was Hikma Pharmaceuticals, whose shares climbed almost 5% after the London-listed company beat 2019 profit expectations on the back of new drugs.