Cardi B’s Performance Unable To Overshadow Pepsi’s Anti-competition Tendencies

Share

This weekend went down as one of the best highlights in the Nigerian music industry this year for Nigerians. American rapper, Cardi B put on a show – from her entry into Nigeria to her breath-taking performance – that pushed almost every Nigerian out of their worries and the harsh economic reality in the country. However, the excitement didn’t linger enough to douse the anti-competitive practices Pepsi was engulfed in prior to the concert.

While Nigerians might have to vibe to Cardi B’s back-to-back hit songs, it was impossible to shake off the unhealthy competitive tendency of Pepsi that shocked consumers of carbonated soft drinks (CSD) in the last week of November.

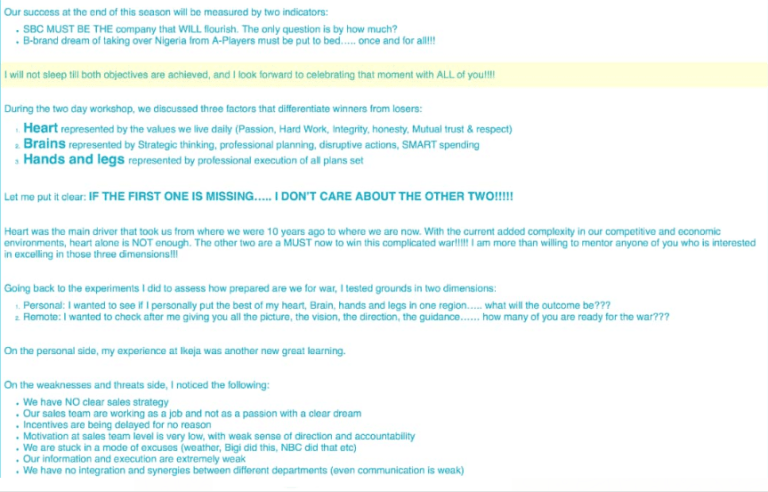

Although, competition is the best thing that could happen to a market. It drives efficiency, promotes affordability, ensures value for money; all to the benefit of the consumers, but when it dives into plotting against a market rival, that’s when competition becomes hazardous; the latter was what was conveyed in a leaked email by the Managing Director of Pepsi Nigeria, Ziad Maalouf.

What happened? An excerpt from the mail reads, “B-Brand (reference to Bigi) disruptive business model will either become a temptation for anyone who has a bit of money to start own brand in Nigeria, or it will be a curse that ensures no one takes such a decision again.”

What decision is Maalouf talking about in the mail? Bigi Drinks (produced by Rite Foods) entered the market with a competitive price and bigger PET bottle to penetrate the CSD market in 2016, at a period Pepsi resized its PET bottle downwards to 50cl but kept product price at N100 and Coca-cola increased its 60cl price to N150. Amidst this price hike and reduced quantity, Bigi offered consumers 60cl at N100.

That was the turning point for all the brands and consumers. Bigi’s price war changed the status quo in the CSD market. For more than two decades, Pepsi (bottled by Seven-Up bottling Company, SBC) and Coca-cola (bottled by Nigerian Bottling Company, NBC) had major control over the market, but Bigi’s disrupted entry cost them valuable share.

Why Nigerians need to be worried:

While an offense marketing response is expected from a company that has taken a hit from a smaller rival, what is shocking is the power play being pulled by Pepsi. The message is clear, Pepsi is not just coming for Bigi, the only Nigerian-owned soft drink brand, the company is also looking to shutout aspiring Nigerian brands from entering the CSD market.

Although, Pepsi is positioned as a Nigerian brand, but it’s just another franchise of a foreign brand no different from Coca-cola. While it’s contribution to the employment market is commendable, the company’s proposed response to Bigi’s market presence pose a threat to not just Bigi, but to also the employment market which will have a ripple effect on the Nigerian economy.

Just as the growth of Bigi drinks resulted into the employment of many Nigerians, if Pepsi achieve its aim against Bigi, it will lead to the loss of several jobs, and even discourage new investors from establishing river brands, thereby, killing future job creation in the CSD market. So there’s need to protect smaller brands from the claws of the major players like Pepsi which has declared war against smaller brands.